A Credit Reference Form is a typed or handwritten document that confirms the lending capacity of a prospective borrower. This statement can be composed by any financial institution (usually, a bank) that provided financial and banking services to the person or organization to prove the borrower has a good credit history.

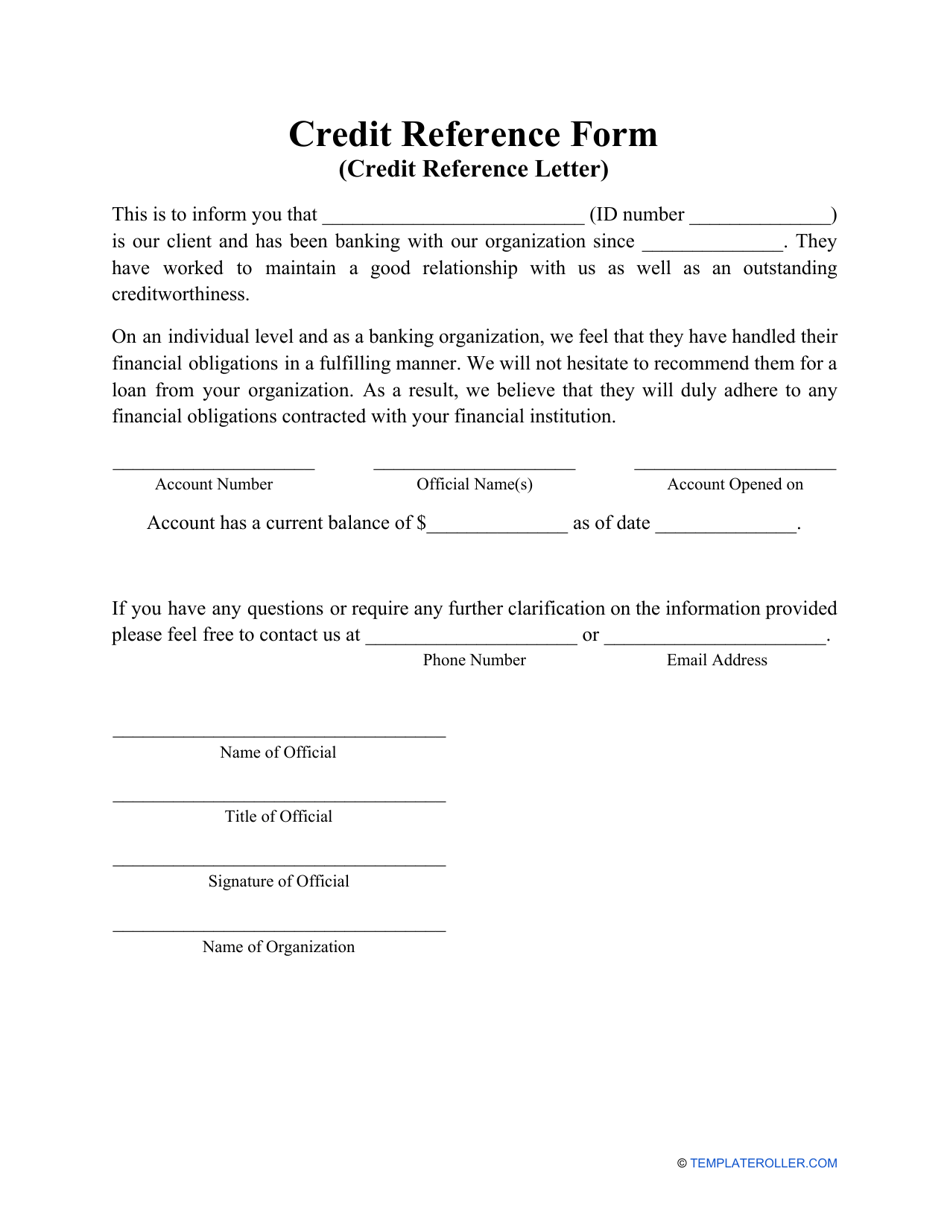

If you are looking for a printable Credit Reference Form template, you can download it below.

Additionally, a Business Credit Reference Form can be drafted by the service provider or any other type of business you have worked with before. Its purpose is to assure the third party - a potential lender - that the borrower is going to pay the money back on time and there are tangible reasons to trust them. A Credit Reference Check Form allows the lender to build confidence and trust in the borrower by learning more about the latter's finances.

ADVERTISEMENTBefore providing credit to a new customer, any lender, whether it is a utility provider or supplier, must know your financial history. You have to prepare a Credit Report Authorization Form - this document will let the lender conduct a background check on you and learn information about your former business dealings - in particular, credit reports. Then, the lender will send a Credit Reference Request Form to your former bank or supplier you have already worked with. In some cases, a future borrower can also request a reference from any bank or business they have had a professional relationship with. Reach out to several companies and institutions at the same time - not everyone will accommodate the request for a reference. Once the request is received and accepted, it is necessary to verify the borrower's creditworthiness and payment history - here is how you compose a Credit Reference Letter:

Haven't found the template you're looking for? Take a look at the related documents below:

Credit Reference Start Date Company Names Previous Employer Accounts Payable and Receivable Monthly Income Rental History Job Title Bookkeeping Credit Score Phone Number Social Security Number Form Employment History Template General Business Forms Business

Legal Disclaimer: The information provided on TemplateRoller.com is for general and educational purposes only and is not a substitute for professional advice. All information is provided in good faith, however, we make no representation or warranty of any kind regarding its accuracy, validity, reliability, or completeness. Consult with the appropriate professionals before taking any legal action. TemplateRoller.com will not be liable for loss or damage of any kind incurred as a result of using the information provided on the site.

TemplateRoller. All rights reserved. 2024 ©

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy.