How to Download Justification Report of errors identified by TRACES

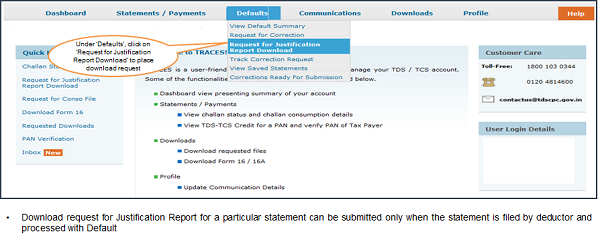

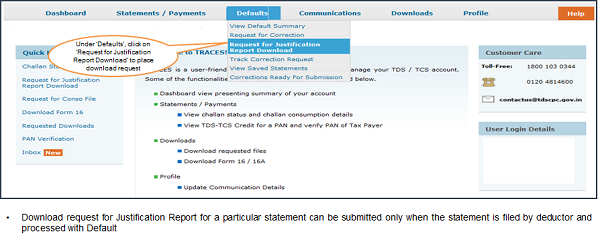

♣ Please check statement status under “Statement /Payment Tab ” before raising the request for Justification Report. Request for Downloading Justification Report can only be Submitted when Statement Status is “Processed with Default”.

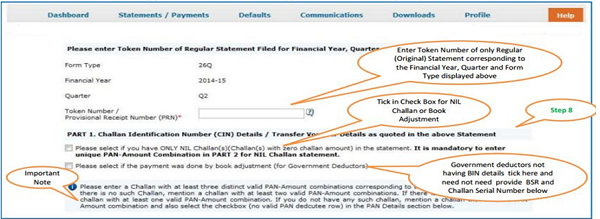

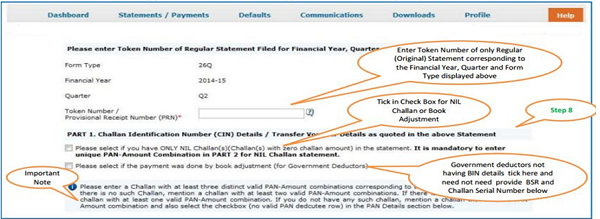

♣ Financial Year, Form type and Quarter for which KYC required will be auto populated on KYC screen. Enter Token Number of the Regular (Original) Statement only, corresponding to the Financial Year, Quarter and Form Type displayed . Enter CIN/ Valid PAN details pertaining to the Financial Year, Quarter and Form Type displayed on the screen on the basis of latest correction statement filed by you(if any). Please DO NOT copy /paste the data.

♣ After providing correct KYC details, an authentication code will be generated, which is valid for same calendar day for same Financial Year, Form Type and Quarter.

♣ On successful submission taxguru.in of the request, a unique Request number will be generated.

♣ Justification Report will be available in “Requested Download”, Deductor can search for Justification Report by using: a) Request Number b) Date c) View All.

♣ Details of Request Status:

a) Submitted: Successful submission, Request in processing

b) Available: Justification Report available for Downloading

c) Disabled: Duplicate request submitted for downloading

d) Failed: User are advised to contact CPC(TDS)

e) Not Available: Statement processed without default

Important Information on Justification Report

- Justification Report consists detailed information about the defaults/errors identified by the TRACES (CPC TDS) while processing the original/correction taxguru.in statement filed by deductor for the particular quarter, financial year and Form Type.

- It helps Deductor to identify the default at Statement Transaction level and to rectify them.

- Justification Report is available from financial year 2007-08 onwards.

- Deductor can download Justification Report by using HTTP Download or Download manager accordingly once it is available.

- Downloaded file will be in ZIP format , it has to be extracted with the password.

- The password for opening Justification Report is JR_TAN_FormType_Quarter_FY, i.e., JR_AAAA11111A_24Q_Q3_2010-11for statement processed by TRACES.

- Deductor needs to download the Utility V 2.2 from TRACES website to convert downloaded Justification report into Excel format.

- Justification Report will be generated and will be saved in the destination folder selected by Deductor.

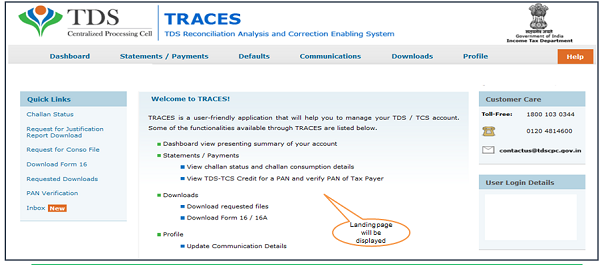

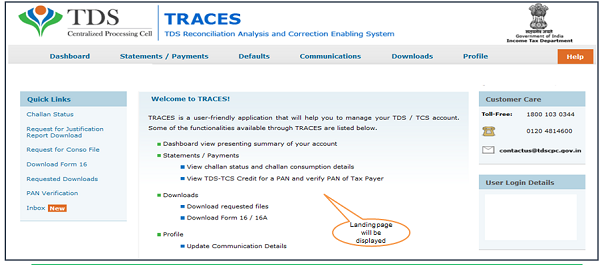

Login to TRACES

Welcome Page

Select Request for Justification Report

Enter Search Criteria

Digital Signature supported KYC Validation contd. (Step-1)

- Digital Signature Support KYC validation screen will appear only if Digital Signature is registered. Deductor can register/re register their Digital Signature in Profile. Please refer – Digital Signature Certificate Registration e-Tutorial for more information.

- Normal KYC Validation (without Digital Signature) – User can opt a normal KYC validation separately for each functionality without digital signature.

Digital Signature supported KYC Validation contd. (Step 2 & 3)

Digital Signature supported KYC Validation contd. (Step 4 & 5)

Note: ‘Signing data with your private exchange key’ with not be displayed if security level has been chose’ as medium / during installing DSC in browser hard token and ‘applet window?( as shown in the next screen will appear directly.

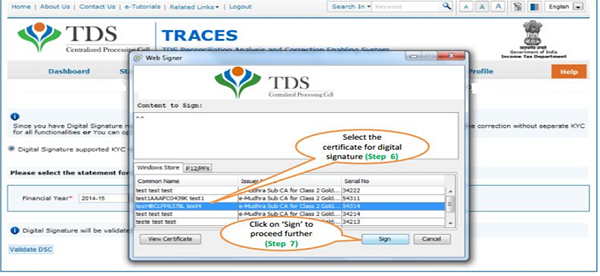

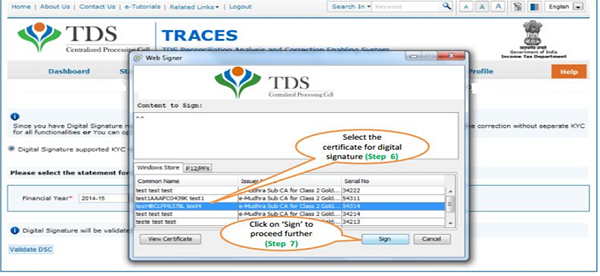

Digital Signature supported KYC Validation contd. (Step 6 & 7)

Digital Signature supported KYC Validation (Step 8)- KYC of the FY+ Quarter+ Form Type selected in Step 2 will be displayed

- Authentication Code will not appear on the screen in case DSC Supported KYC

- In one session this manual KYC page ( On the basis of input selected by the user ) will be displayed only once

Token Number Details (Contd.)

Digital Signature supported KYC Validation – Success Page

In case of Normal KYC Validation- Token Number Details

Token Number Details (Contd.)

Notes for Validation Screen:

- Authentication code is generated when you clear validation details which remains valid for the same calendar day for same form type, financial year and quarter.

- Token Number must be of the regular statement of the FY, Quarter and Form Type displayed on the screen.

- CIN details must be entered for the challan which is deposited and mentioned in the statement corresponding to the FY, Quarter and Form Type mentioned above.

- Transfer Voucher details to be entered for government Deductors.

- Amount should be entered in two decimal places (e.g., 1234.56).

- Maximum of 3 distinct valid PANs and corresponding amount must be entered.

- If there are more than three such combinations in the challan, user can enter any three valid PAN.

- If there are less than three such combinations in the challan, user must enter all (either two or one) valid PAN details.

- PAN mentioned should be related to the challan/BIN details mentioned in Part 1.

- CD Record no. is mandatory only in case challan mentioned more than once in the statement.

Authentication Code Screen

Request Number Screen

In order to check Request Status Click on Requested Downloads

- File will be available in ‘Requested Downloads’

Check the Status of Request submitted

Click to Download File

- HTTP Download is useful to download small files. It will directly download file for the user

- Download Manager is useful to download large files and where internet bandwidth is slow.

Step to Download Justification Report Utility

Procedure to Download Justification report Utility V 2.2

Downloading Justification Report

Justification Report Generation Utility

Justification Report Generation Utility (contd.)

Steps to Use Traces Justification Utility

Justification Utility Steps

Justification Utility Steps

- Justification Report will be converted into Excel and will be saved in the destination folder selected in the previous step.