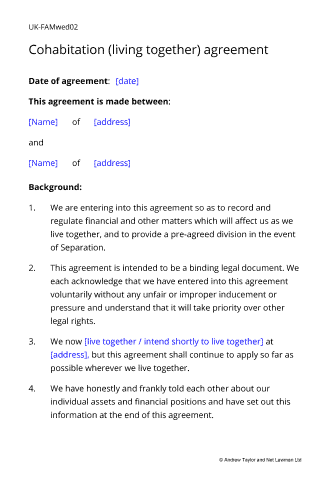

Use this cohabitation agreement to create a written record of understanding between the parties currently living together or planning to do so in the future. It allows you to agree on the distribution of finances, responsibilities and assets and the provision of child arrangements.

Compliant with the latest law in

Microsoft Word DOCX Apple Pages RTF

Backed by our watertight guaranteeIf the document isn’t right for your circumstances for any reason, just tell us and we’ll refund you in full immediately.

Written in plain EnglishWe avoid legal terminology unless necessary. Plain English makes our documents easy to understand, easy to edit and more likely to be accepted.

Guidance notes includedYou don’t need legal knowledge to use our documents. We explain what to edit and how in the guidance notes included at the end of the document.

Support from our legal teamEmail us with questions about editing your document. Use our Lawyer Assist service if you’d like our legal team to check your document will do as you intend.

Up to date with the latest lawOur documents comply with the latest relevant law. Our lawyers regularly review how new law affects each document in our library.

The decision to move in and live together is a significant one. Not only can it be a large commitment to a relationship; it can change your finances, ownership and use of your possessions, and children arrangements.

Although there are big lifestyle changes to be made when you start living together, it might be more important to consider what would happen if you were to split up subsequently.

Many cohabiting couples assume that if they are living together unmarried then there are rules of common law marriage that give some legal protection on break up in the same way as the law does for married couples.

However, common law rights are a myth. Even if your relationship is a long-term intimate one rather than a short-term living together arrangement, unlike in a marriage or civil partnership, you have no special rights under statute law.

The solution is to use a cohabitation agreement.

A cohabitation agreement (also known as a living together agreement and a no nup agreement) is a written contract between people who live together or are planning on living together who are neither married nor civil partners.

A cohabitation agreement can be used to set down, amongst other practical matters:

A cohabitation agreement is a very practical, legally binding document that can cover as much or as little as you like.

If you are unmarried, neither in a civil partnership, and your relationship breaks up, you really are on your own.

This cohabitation agreement template helps you to work out and set down all the practical arrangements that need to be covered when two people who are neither married nor civil partners form a household.

We include optional paragraphs to allow you to sever a joint tenancy (if you own your property together) and to become tenants in common. If you aren't aware of the differences between joint tenancy and tenancy in common then in short, being tenants in common means that you both own separate shares in the property, rather than being joint owners of the whole.

This document does not try to tell you what is best for you, but to steer and guide you into considering and dealing with the most important issues, so you can create your own cohabitation agreement.

This cohabitation agreement covers arrangements about your joint bank accounts, home, business assets, who owns personal property, banking and money arrangements - and even provisional child support arrangements (which are not binding in law but would be taken into account by a judge).

The agreement can be used at any stage of living together before marriage.

In England and Wales, and in Scotland, a cohabitation agreement forms a legally binding contract provided certain conditions are met.

The most important of these conditions in respect of all family law documents is that the parties entered into the agreement of their own free will and in the knowledge of what they agree to.

When cohabitation agreements are challenged in court, it is often on the basis that one person was coerced or didn't understand the implications of the contract.

One 'insurance policy' against such a claim is for both partners to obtain independent legal advice, preferably from separate firms of solicitors both specialising in family law. If the relationship does end, then neither can say that they didn't understand the implications.

However, in many cases, obtaining separate counsel is expensive. Particularly for younger cohabiting couples, where the risks of breaking up are lower because there are no children and no valuable assets to protect, the benefit of taking legal advice is reduced.

Since a cohabitation agreement can be entered into at any time in a relationship and later remade, younger couples may want to make one that covers a simpler relationship now, and remake one taking advice when life includes kids, mortgages, pensions and business assets.

There are other ways to record property ownership. You can record fixed ownership percentages at the Land Registry and flexible ownership percentages in a declaration of trust or tenants in common agreement. You can also make a Will at any time.

This template does not require any special action after you have edited it. It will be binding on both sides as you both sign and date one copy (although we advise that you print, date and sign two copies so that you both have one).

Your completed document will continue to be valid until you are married or a child is born.

We use DocX format for our documents. Most word processing software can read it. If you ask us, we can convert a document to other formats for you as well.

Yes. You can edit the template as much as would like. Our detailed guidance notes help you decide what to edit, from adding or removing paragraphs to simply changing fonts and colours.

A cohabitation agreement can be put in place at any time. Many couples do so just after they start to live together, and realise that practical matters need to be considered.

Importantly, the cohabitation agreement should be reviewed whenever there is a significant life event such as buying a property together, having a child, inheriting money, a change in financial status, or personal injury.

If you later decide to get married or enter into a civil partnership, your cohabitation agreement can be used as the basis for a prenuptial or postnuptial agreement.

If you get married or enter a civil partnership in the future, the legal status of the document changes. It becomes more like a prenuptial agreement. The effect is that if you then separate at some future date, the court will take this legal document into account, but will not be bound by it.

You will often read that each partner needs to seek independent legal advice before signing the cohabitation agreement. The reason for this is that, like any other family law document, a living together agreement is only enforceable if both partners entered into the agreement freely and knew the implications of signing at the time (which can evidenced by the fact that the two parties sought independent legal advice).

Independent legal advice is not a requirement, but rather protects against the risks that you might not know what you are signing up to, or that your partner later claims that he or she did not. Whether you seek legal advice or not is very much a decision for you, based on the risks you perceive to exist.

If you would like reassurance that the document will achieve what you intend, then our lawyers can review it before you sign it and bring your attention to any matters you might have missed.

No. Both sides should simply keep a signed copy of the cohabitation agreement safe for future evidence of what was agreed.

Drawing up a cohabitation agreement may incur a small cost now, but can save you time, money and worry if you separate whilst living together.

Having an agreement in place isn't a guarantee against disagreements over how assets should be divided if there is a relationship break up. However, it does act as a record of what you agreed, which makes disputes less likely and resolving them faster.

Resolving disputes may not necessarily require you to go to court. Mediation may be possible. But either route is likely to be more expensive than the cost of drawing up a cohabitation agreement.

Our cohabitation agreement covers the important aspect relating to a cohabiting couple, including the following:

If one of you owns the home you live in his or her sole name, the other has no automatic right to stay if the relationship breaks up.

That is the case even if the non-owner pays towards the mortgage or running costs. The only exception to this rule is if you have agreed otherwise in either a cohabitation agreement or in a licence agreement that gives you the legal right to occupy the property.

If you are contributing to the mortgage and want your payments to be recognised as such, rather than as rent, then the starting point is to agree who owns what share of the property and whether the shares change over time.

Then you need to consider what might happen in the future and plan for what you would like to happen.

If ownership changes, you may need to tell the Land Registry, or use a tenants in common agreement to define the ownership split.

Some possessions are easy to divide.

You can agree that any personal possessions you brought into the relationship (such as inherited furniture) are yours if you no longer live together.

You can split the money in joint bank accounts.

More difficult is to decide how large, less easily divided assets should be split. Assets like these might include life insurance policies or pensions, where one of you has contributed salary to savings while the other has used income to meet day to day requirements.

One solution, which Net Lawman's living together agreement provides, is a proposal for a graduated capital payment depending on the comparative wealth of both parties. You can decide exactly how it works under our framework.

Even though you are not married, you can agree for one of you to pay the other monthly maintenance. There is great flexibility on the arrangement you can choose - much greater than if you are married or civil partners.

It is a good idea to differentiate between payments that are intended to contribute to household bills that one party pays and payments for lifestyle living expenses.

Bear in mind that maintenance payments tie you together after you split. It might be preferable for you both if one partner gives the other a lump sum, or a graduated capital sum rather than an on-going payment. Certainly, this can be safer if the circumstances of the person paying maintenance change.

Even if you don't have children now, you might in the future, so your agreement should consider them.

If the parents of a child are unmarried, then only the mother has any automatic rights in respect of the child. She alone will have parental responsibility for the child. However, since 1 December 2003 (s111 of the Adoption & Children Act 2002) it is now easier for an unmarried father to acquire similar rights. All he needs to do is to register the birth of the child with the mother.

An unmarried father can also acquire joint parental responsibility or even sole parental responsibility, by applying to the court for an order. He can apply for joint parental responsibility, a residence order (that the child lives with him rather than his or her mother), or a contact order (that he should be entitled to see his child on a regular, specified basis).

With same-sex civil partnerships, rights can be less clear.

A more immediate problem might arise if the parties fall out, and separate and fight over the children immediately. If it is clear that the children are suffering or may suffer, it is likely that the local authority will take them into care. A well-constructed agreement, followed by the parties when the bad times come, will enable the children to continue their lives as near normal as possible, as well as the parents their own lives.

However remote the chance of death of one of you may seem, you should consider and account for it. After all, you are entering into a cohabitation agreement largely as an insurance policy, so you may as well deal with the risks thoroughly.

There is an additional potential problem with death: either party may change a will at any time and if there is none, the normal rules of intestacy apply. A 'life partner' is entitled to nothing by law, unlike married couples where the surviving spouse receives the whole estate.

If you both die within a short time of each other, your next of kin may find it difficult to determine what each of you owned. It may be necessary for your executors to go to court to resolve arguments. A cohabitation agreement helps avoid this.

If you have taken out life insurance or you are entitled to death-in-service insurance as part of your employment benefits package, you can confirm in the cohabitation agreement that you would like your partner to receive some of the cash sum paid on your death.

We recommend that cohabiting couples also each make a will. We provide a number of last will and testament templates, one of which should be suitable. Simpler ones are even free.

It often happens that at some stage of the relationship, partners in personal life decide to become partners in a business.

While it is impossible to know what the future holds, let alone plan for it, the long version of the Net Lawman cohabitation agreement provides a framework into which you can plan for possibilities.

You can keep business arrangements at arm's length by using other business structure documents, such as a partnership agreement or a shareholders agreement. You can also separate business finance from personal finance by documenting loans and investments.

We are happy to answer any questions you have. Arrange for us to call you.